What Is an Investment Policy Statement?

Most people have investment goals, and the path to achieving these goals

We don’t believe in a set-it-and-forget-it financial plan. We have created a proactive and engaging process that keeps you in alignment with your unique goals and values. Together, we’ll adjust your plan as life changes.

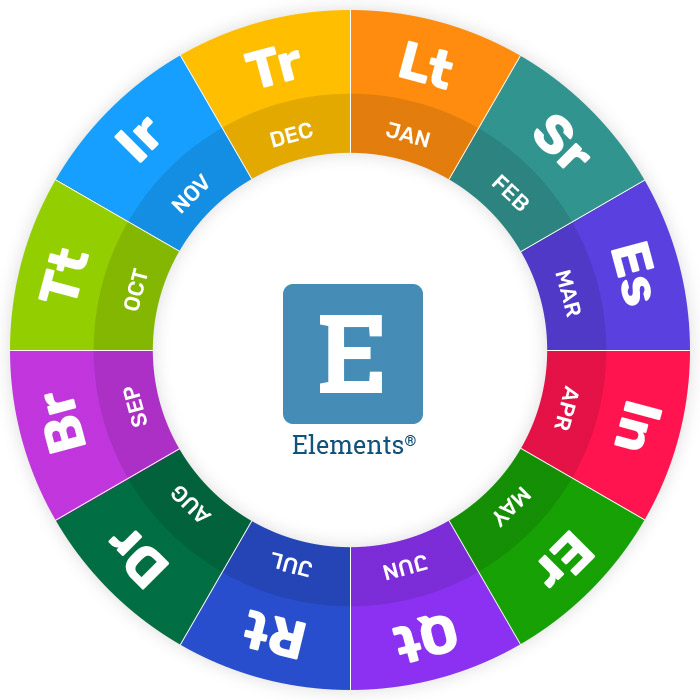

Through our Elements® approach, we leave no stone unturned in the creation of your financial strategy. We’re able to consistently monitor your financial life with a 360° view of everything that could impact your goals.

We genuinely care about helping you gain clarity around what you want out of your day-to-day life, and how you want your future legacy to look. Our mission is to help you define those key things and help you get there.

Elements® is a unique, modern financial planning platform that Frame Wealth Management leverages on behalf of our clients in four easy steps:

Together, we’ll gather and organize your financial information upfront.

Then, our app will help keep your data up-to-date with prompts when things get stale.

We’ll regularly analyze your financial health scores to identify ways to help you improve.

And each month we’ll deliver a report through our app that highlights all the progress you’ve made.

We’ll use your performance summary and progress report to help you decide if any adjustments should be made to your plan.

We’ll share recommendations with you by email, Zoom video meetings, or phone.

Click Each of the Elements® Below to Learn More

We address your financial health on a monthly recurring schedule, ensuring that we can touch on the foundational Elements® of your financial life month after month, year after year.

It’s been a wonderful and amazing journey. One that keeps me filled with passion for my clients and career each and every day. Click below to learn all about it…

Most people have investment goals, and the path to achieving these goals

Jessica has contributed to her employer-sponsored individual retirement account (IRA) plan for

Social security benefits make up a large part of retirement planning, especially

Frame Wealth Management LLC is an investment adviser principally registered in New York and California, and registered or exempt from registration in other states as applicable. Nothing presented on or through this page is intended to be personalized investment, tax, legal, accounting, or any other professional advice. To the extent this page includes content related to investment, tax, legal, or accounting matters, such content is expressly for general information purposes and should not be relied upon for any decision-making. Investment, tax, legal, accounting and other professional advice is specific to each individual and entity, and you should consult with a professional advisor to receive such personalized advice.

Nothing contained on this page should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or other financial product or investment strategy. To the extent any security or other financial product or investment strategy is referenced or discussed on this page, you should understand that past performance is no guarantee of future returns and that investing in any security or other financial product or investment strategy can result in the partial or complete loss of principal. Investing involves risk that you as an investor should be prepared to bear.

The Elements(R) application and associated digital tools are designed and developed by Elements Technology, Inc., an independent and unaffiliated third-party software company. Elements(R) is used under license from Elements Technology, Inc.